Cutting-Edge AI Tools for Stock Market Analysis

In the fast-paced world of stock market investing, leveraging artificial intelligence (AI) has become a game-changer. AI tools for stock market analysis are revolutionizing how investors predict market trends, manage risk, and optimize portfolios. By integrating AI algorithms, including technical analysis, sentiment analysis, and algorithmic trading, these advanced tools offer predictive insights and real-time analysis, pushing the boundaries of traditional investment strategies.

The advent of AI in investing has led to the development of sophisticated platforms that cater to a wide range of needs, from automated trading to personalized investment advice. This guide explores the best AI stock trading app and best AI investing platform options available to investors. By employing artificial intelligence, risk management protocols, and AI chatbots, these platforms aim to empower investors with the tools they need for success. Through careful analysis and expert insights, we'll navigate the intricate landscape of AI tools, highlighting their importance in modern trading and investment strategies.

Table of Content

- Introduction

- EquBot

- Trade Ideas

- TrendSpider

- Tradier

- QuantConnect

- Sentient Trader

- Awesome Oscillator

- Stock Rover

- AlphaSense

- Alpaca

- StockPulse

- Freshly

- Avanz

- Alpha Research

- StockGPT

- Trade Foresight

- Quadency

- Kavout

- Danelfin

- Truewind

- Conclusion

- FAQs

EquBot

EquBot stands at the forefront of AI-driven stock market analysis, utilizing an impressive array of data sources and advanced machine learning techniques. Daily, the platform analyzes over one million global news articles, social media posts, financial statements, and more, in multiple languages. This deep and broad data integration allows EquBot to keep a pulse on market sentiment and emerging trends across 50,000 global companies and various asset classes.

Key Features and Capabilities

- Comprehensive Data Analysis: EquBot processes vast amounts of data including economic indicators, company financials, and market sentiment from diverse sources.

- Advanced Machine Learning Models: Utilizes over 200,000 company-specific models, continuously running to refine and enhance predictive accuracy.

- Multi-Factor Assessment: Evaluates companies on 34 financial metrics and gauges market sentiment using 22 different factors, providing a nuanced view of potential investment opportunities.

EquBot not only synthesizes complex data but also offers actionable insights through its AI-powered ETFs, such as the AI Powered Equity ETF (AIEQ) and AI Powered International Equity ETF (AIIQ). These ETFs leverage machine learning to optimize portfolio performance by assessing risk and return profiles across multiple time horizons. The platform's ability to backtest strategies and provide real-time analysis helps investors stay ahead of market shifts, ensuring informed decision-making in a dynamic investment landscape.

Trade Ideas

Trade Ideas emerges as a highly sophisticated AI-powered stock market analysis tool, catering to a diverse range of investors, from novices to seasoned traders. This platform harnesses the power of AI cloud computing to meticulously sift through massive volumes of data, pinpointing unusual stock behaviors and market opportunities. Its robust features include real-time stock scanning, comprehensive analysis, and advanced risk management tools, all designed to refine trading strategies and enhance profitability.

Key Features and Capabilities

- Real-Time Market Scanning and AI-Driven Trade Signals: Trade Ideas offers continuous market monitoring and instant trade signals based on sophisticated algorithms, which adapt to market conditions in real-time.

- Customizable Trading Strategies and Alerts: Users can tailor their trading approaches with customizable strategies and alerts, ensuring they are equipped to respond swiftly to market changes.

- Advanced Charting and Data Visualization Tools: The platform provides advanced charting capabilities, including Picture-in-Picture features, allowing for detailed market analysis and efficient decision-making.

Trade Ideas not only facilitates active trading but also provides a comprehensive educational framework to support its users. This includes access to day trading courses, live education sessions, and a wealth of resources such as books and trading tools. The platform’s integration with top brokers like Interactive Brokers and TradeZero enhances its utility by offering low-cost trades and direct market access, respectively. Additionally, the availability of a simulator allows traders to practice strategies in a risk-free environment, making it an invaluable tool for both learning and experienced trading.

TrendSpider

TrendSpider stands out as a revolutionary AI-powered trading software, meticulously designed to cater to both novice and professional traders. By integrating advanced algorithms and machine learning, the platform automates technical analysis, enhancing trading efficiency and accuracy. TrendSpider's robust suite includes a variety of tools such as automated chart pattern recognition, strategy testing, and real-time alerts, making it an indispensable tool in the trader's arsenal.

Key Features

- Automated Technical Analysis: Utilizes machine learning to automatically identify and analyze chart patterns, reducing human error and increasing consistency in trading decisions.

- Comprehensive Scanning Tools: Offers daily scanners for high-volume gappers, movers, and stocks exhibiting bullish momentum or breaking out from chart patterns.

- Advanced Charting Tools: Provides a range of charting options, including custom workspaces and drawing tools, back to the 1990s data for in-depth historical analysis.

The platform not only simplifies the workflow through automation but also offers extensive customization options to suit various trading styles. With features like dark mode, a robust login system, and a marketplace for trading strategies and bots, TrendSpider is engineered to optimize trading performance. Additionally, the platform supports a wide range of third-party indicators and scanners, enhancing its versatility and appeal to a broad audience of traders.

Education and Support

- TrendSpider University: A comprehensive educational resource offering tutorials on chart patterns, technical indicators, and trading strategies.

- Support Options: Includes a dedicated support center, email, phone support, and 1-on-1 training sessions to assist users in maximizing the platform's potential.

TrendSpider's commitment to education and support underscores its role as a leader in AI-driven trading technology. The platform's continuous innovation is evident in its regular software updates and the inclusion of features like simulated paper trading, which allows traders to practice and refine strategies without financial risk.

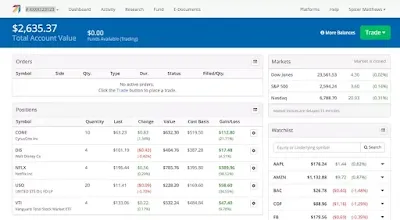

Tradier

Tradier distinguishes itself as a robust broker-dealer platform designed for stock, option, and ETF trading, providing a comprehensive suite of fully hosted APIs. These APIs cater to various needs, from market data feeds to brokerage capabilities, making it an ideal choice for developers looking to integrate advanced trading functionalities into their applications. Tradier offers two main plans: the Standard and Pro. The Pro plan, priced at an additional $10/month, includes exclusive features enhancing the trading experience on both web platforms and mobile apps.

Key Features of Tradier's Platforms

- Broad API Integration: Tradier's API suite allows for seamless integration into custom applications, providing access to real-time and historical market data, along with advanced brokerage functions.

- Diverse Trading Options: Users have access to stocks, options, mutual funds, and ETFs, with commission-free equity trades and competitive options pricing up to $0.35 per contract.

- Advanced Trading Tools: The platform supports automated trading and high-level integration with tools like TradingView and TrendSpider, where strategies can be automated and trades executed directly through Tradier.

Tradier not only supports a wide array of trading functionalities but also focuses on accessibility and education. With over 100 connected platforms, it offers resources for educators and advisors to enhance their offerings. The platform's commitment to compliance and user safety is evident as it regularly engages with regulatory authorities to ensure adherence to relevant laws. Additionally, Tradier's innovative approach includes features like fractional trading in cryptocurrencies and a robust support system for both new and experienced traders.

QuantConnect

QuantConnect emerges as a powerhouse in the realm of algorithmic trading, providing a robust platform for quant investors to develop and deploy complex investment strategies. Since its inception in 2012, it has attracted over 250,000 quants and engineers, who leverage its capabilities to craft and test their trading ideas. The platform is particularly noted for its comprehensive access to a wide variety of data types, including financial, fundamental, and alternative data, all accessible through a free user account.

Key Features and Capabilities

- Extensive Asset Compatibility: Supports a diverse range of assets including US Stocks and ETFs, Equity Options, Indexes, Futures, Forex, and even Crypto.

- Rich Data Library: Offers access to an expansive library of alternative data from over 40 vendors, enhancing the breadth of potential trading strategies.

- Advanced Data Handling: Features a sophisticated data delivery system that ensures uniform timestamping and accurate corporate action tracking, crucial for developing reliable trading models.

QuantConnect's dedication to innovation is further exemplified by its Lean Algorithm Framework, which simplifies the coding process for users. This open-source library aids in crafting efficient and effective algorithms by providing a powerful backtesting engine, which allows traders to simulate and tweak their strategies using historical data. Additionally, the platform boasts a co-located live-trading environment, handling $1-2 billion in notional volume each month, which underscores its capacity for high-volume, real-time trading operations.

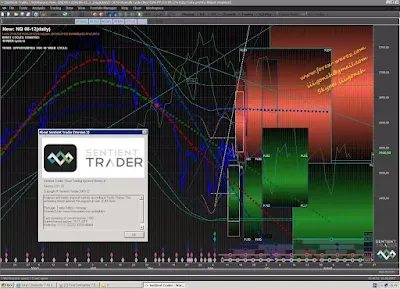

Sentient Trader

Sentient Trader harnesses the cycle analysis techniques pioneered by JM Hurst over 50 years ago, offering a refined approach to financial market trading. This flagship software utilizes Hurst's original analysis process, providing traders with a deep understanding of market dynamics influenced by multiple dynamic cycles. These cycles, neither purely mathematical nor random, reveal a hidden rhythm in market movements, enabling users to make more informed and consistent trading decisions.

Key Features of Sentient Trader

- Expert Analysis: Employs Hurst’s Original Analysis Process to deliver expert market insights.

- Identify Trading Opportunities: Equipped to pinpoint potential trading opportunities using End of Day (EOD) and Intraday data down to 1-minute charts.

- Education and Training: Focuses heavily on user education, offering the FLD Trading Strategy course praised for its effectiveness in real-world trading.

Pricing and Subscriptions

- Software Licensing: Sentient Trader can be activated on up to three computers, offering flexibility for non-concurrent use.

- Subscription Options: Users can subscribe to various services, including Hurst Cycles Online, which identifies trading opportunities in popular markets like indices, forex, and crypto. Subscription packages vary, with a 3-instrument portfolio available for $39/month, an 8-instrument portfolio for $79/month, or access to all instruments for $129/month.

- Trial and Training Bundles: A 30-day trial is available for US$ 29, and the website offers bundled courses with software to accelerate the learning curve.

Sentient Trader not only provides advanced analysis tools but also integrates various data sources, including Yahoo Finance and MetaTrader 4, ensuring comprehensive market coverage. Its approach to cycle analysis, described as more art than science, involves advanced pattern recognition techniques that mimic human analytical skills, allowing for dual analysis of market troughs and peaks. This sophisticated tool is designed for professional traders seeking to leverage historical and real-time data to enhance trading accuracy and profitability.

Awesome Oscillator

The Awesome Oscillator (AO) is a dynamic histogram tool that measures the momentum of a stock's price movement, providing insights into market strength or weakness. Developed using two simple moving averages (SMAs) over 34 and 5 periods, AO offers a clear visual of market dynamics by plotting real-time data above or below a zero line. This indicator is widely accessible on platforms such as Tradingview, MetaTrader, Investing.com, StockCharts.com, and Yahoo! Finance, making it a versatile tool for traders across various markets.

Understanding AO Signals

AO's utility in trading is evident through its straightforward signal system:

- Zero Line Crossover: A movement from below to above the zero line suggests bullish momentum, indicating potential buy signals. Conversely, a drop below this line signals bearish momentum, hinting at sell opportunities.

- Saucer Strategy: This involves identifying rapid changes in histogram bars, allowing traders to catch shifts in momentum early.

- Twin Peaks Method: This strategy focuses on the peaks formed by the histogram above or below the zero line, offering clues about impending market reversals.

Combining AO with Other Indicators

To enhance trading accuracy, AO can be effectively combined with other technical analysis tools:

- Stochastics and RSI: These momentum indicators can confirm AO signals, particularly during overbought or oversold conditions.

- MACD: When used alongside AO, MACD can help confirm the strength of trend changes detected by AO, providing a more robust trading strategy.

The Awesome Oscillator not only aids in identifying market trends and potential reversals but also complements various trading styles by integrating with additional technical tools. Available on platforms like AvaTrade, it extends its functionality to a broad spectrum of financial assets, including Forex, Stocks, and Cryptocurrencies, enhancing its appeal to a diverse range of traders.

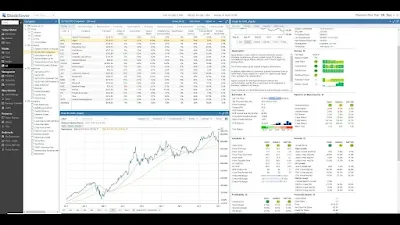

Stock Rover

Stock Rover, acclaimed as the 'Best Buy and Hold Screener' by Investopedia in 2024, integrates cutting-edge AI capabilities to enhance market scanning and trading idea generation. This platform excels in both technical and fundamental analysis, providing a wealth of information that allows investors to deeply understand and evaluate stocks.

Key Features and Capabilities

- Comprehensive Data Analysis: Stock Rover offers an extensive range of financial metrics, including Morningstar grades, ex-dividend dates, and peer comparisons, alongside in-depth financial statements.

- Customization and User Tools: Users can enjoy a high degree of customization with tools like the searchable note-taking facility for premium members, customizable views to manage data presentation, and expandable table rows for a historical data perspective.

- Advanced Screening and Reporting: The platform allows users to create personalized metrics with its Equations and Custom Metrics feature, tailored to their specific investment strategies. Additionally, Stock Rover provides detailed research reports on over 7000 North American companies, enhancing investment decision-making.

The platform supports a variety of user needs from basic to advanced, with tools for side-by-side comparison of stocks, ETFs, and portfolios across hundreds of financial metrics. For those looking to dive deeper, Stock Rover's customizable Peers table and the ability to chart up to twelve different lines simultaneously offer unparalleled data analysis capabilities. This robust suite of tools makes Stock Rover an indispensable resource for investors aiming to maximize their market strategies.

AlphaSense

AlphaSense stands as a premier market intelligence platform, employing advanced AI technology to furnish professionals across various industries with crucial insights for informed decision-making. This platform is renowned for its access to a wealth of premium content, including regulatory documents, broker research, expert calls, and more. It caters to a diverse clientele, including financial services, asset management, and corporate banking, offering tailored solutions like Market Intelligence, Enterprise Intelligence, Wall Street Insights®, and Expert Insights.

Comprehensive Solutions Offered by AlphaSense

- Market Intelligence: Provides real-time tracking of critical insights, enabling users to search across companies, industries, trends, or topics efficiently.

- Enterprise Intelligence: Features a secure, AI-powered platform that integrates proprietary internal content with premium external content for comprehensive market intelligence.

- Wall Street Insights®: Offers exclusive access to leading equity research from major Wall Street firms, supporting rigorous financial analysis.

- Expert Insights: Allows access to a vast library of expert call transcripts or the option to conduct cost-effective expert calls, enhancing understanding and strategy development.

AlphaSense not only supports a broad spectrum of industries but is also trusted by a majority of the S&P 500 companies and top asset management firms globally. Its advanced AI search technologies, including Smart Synonyms™ and sentiment analysis, are pivotal in delivering precise and relevant market insights. The platform's extensive content sets, from broker research to regulatory filings, are all searchable and indexed in one place, making it an invaluable resource for competitive intelligence, market research, and strategic planning.

Alpaca

Alpaca stands out as a comprehensive trading platform that caters to both individual investors and business clients, offering a wide array of trading options including stocks, ETFs, and cryptocurrencies. The platform's developer-first approach is evident in its robust API offerings, which allow businesses to seamlessly integrate trading capabilities into their applications. This includes the Broker API, Trading API, Market Data API, and OAuth, all designed to provide scalable solutions across various financial services.

Key Features of Alpaca Trading Platform

- Comprehensive Asset Options: Alpaca supports trading in stocks, ETFs, and cryptocurrencies, providing a versatile platform for diverse investment strategies.

- Developer Tools and Integration: Offers a suite of APIs and SDKs, making it easier for developers to build customized trading applications. These tools are supported by Alpaca’s presence on GitHub and a vibrant community on Slack, fostering collaboration and innovation.

- Advanced Trading Capabilities: Alpaca allows for algorithmic trading and real-time, event-driven architecture, which are crucial for high-frequency trading and building backtest algorithms.

Alpaca’s commitment to providing a scalable and compliant trading infrastructure is further supported by its modern RESTful Web API, which adheres to stringent regulatory standards set by bodies like the SEC and FINRA. The platform’s infrastructure is designed for high scalability, supporting a wide range of trading activities from fractional and notional trading to comprehensive order management systems. Additionally, Alpaca offers specialized accounts like the Broker API Account, which provides tools necessary for creating diverse applications tailored to specific trading or investing needs. These features make Alpaca a preferred choice for tech innovators, broker-dealers, and registered investment advisors looking to leverage powerful trading technology in their operations.

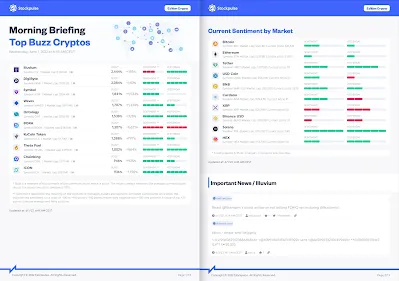

StockPulse

StockPulse utilizes its advanced AI capabilities to analyze financial news and communities, efficiently processing information from over 200 million diverse sources worldwide. This extensive coverage enables the platform to collect, filter, match, score, and augment unstructured data, transforming it into actionable insights. The AI-driven solutions offered by StockPulse include a variety of tools and datasets tailored for different market needs, such as Trading Surveillance, Crypto Surveillance, and AI Automated Reports, which are crucial for detecting and analyzing market trends and risks.

Key Offerings of StockPulse

- Datasets and LLM Training Datasets: Provides comprehensive data solutions that support deep learning and algorithm development.

- AI Alpha Signals and Industry Analyzer: Delivers predictive signals and industry-specific analysis, enhancing investment strategies.

- Crime & Cyber Intelligence: Offers tools for uncovering unlawful activities in financial markets, critical for regulatory compliance and security.

StockPulse's innovative approach extends to social media and web monitoring, where its AI algorithms perform sentiment analysis to gauge market moods and trends. This capability not only helps in enhancing alpha but also plays a pivotal role in increasing engagement with existing customers and attracting new clients to trading platforms. The platform's adaptability is evident in its customizable project development that supports real-time, 24/7 monitoring, ensuring that users can continuously track market perceptions and opportunities. Furthermore, StockPulse is trusted by leading financial and regulatory organizations, including Interactive Brokers Group and the Trading Surveillance Office of the Frankfurt Stock Exchange, to provide advanced sentiment and quantitative analyses.

Freshly

Freshly emerges as a significant player in the realm of AI-driven stock market analysis, leveraging advanced algorithms to synthesize vast amounts of financial data and provide actionable insights. While AI systems are adept at recognizing patterns and trends from large datasets, the unpredictable nature of the stock market poses a unique challenge, emphasizing the need for sophisticated AI tools that can adapt and learn dynamically.

AI-Driven Predictive Capabilities

- Advanced Algorithms and Machine Learning: Freshly incorporates machine learning techniques to analyze and predict stock market trends. This includes employing natural language processing (NLP) to sift through financial news and algorithmic strategies that automate trading decisions based on real-time data.

- Backtesting and Real-Time Integration: The platform offers robust backtesting tools that allow users to test their strategies against historical data, ensuring strategies are optimized before live implementation. Additionally, real-time market data integration ensures that the trading systems are always aligned with the latest market conditions.

Portfolio Optimization and User Interaction

- Dynamic Portfolio Adjustment: Utilizing AI algorithms, Freshly can dynamically adjust investment portfolios in real-time, optimizing returns as market conditions change.

- AI-Driven Bots for Enhanced User Engagement: The platform employs sophisticated AI-driven bots that quickly process user queries about stock prices, market trends, and relevant news, offering timely and relevant information to help users make informed decisions.

Freshly's technology exemplifies the potential of AI in transforming stock market analysis and trading. By integrating deep learning and neural networks, the platform not only forecasts market trends but also provides a high degree of accuracy and responsiveness, essential for traders in a fast-paced market environment. Companies like Vantage Point AI have demonstrated the efficacy of such technologies, predicting market movements with significant precision, thereby validating the powerful capabilities of AI in financial analysis.

Avanz

Avanz AI, developed by Avanz Innovations, represents a cutting-edge AI assistant tailored for financial data analysis. This sophisticated platform enables users to generate Python code from natural language queries, utilizing popular libraries such as pandas, numpy, matplotlib, seaborn, and sci-kit-learn. Avanz AI's versatility extends across various financial data sources, including stock prices, earnings reports, and balance sheets, making it an invaluable tool for investors, analysts, researchers, and educators.

Key Features and Capabilities

- Code Generation: Automatically generates Python code for complex financial analyses, enhancing efficiency and accuracy.

- Comprehensive Data Handling: Supports a wide array of financial data sources and performs advanced tasks like calculating financial ratios and building machine learning models.

- Insightful Explanations: Provides detailed explanations and insights for both the generated code and its results, aiding in deeper understanding and decision-making.

Avanz Innovations, the powerhouse behind Avanz AI, has been a global leader in technology solutions for over two decades, focusing on areas like blockchain, artificial intelligence, and robotic process automation. The firm boasts a significant global footprint, offering a suite of digital products and platforms that cater to a diverse range of industries including healthcare, manufacturing, retail, and financial services. Avanz AI stands out not only for its technical prowess but also for its ability to drive innovation, creativity, and productivity in financial data analysis.

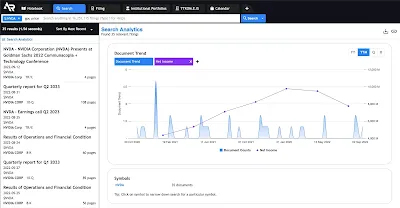

Alpha Research

Alpha Research AI, a fintech innovator, leverages Generative Artificial Intelligence (Gen AI) to transform financial market analysis. By employing Retrieval Augmented Generation (RAG) technology, Alpha Research AI synthesizes and interprets vast amounts of data from diverse sources, including news and investor sentiments. This approach not only enhances the accuracy of market trend predictions but also aids in substantial risk management improvements for equity portfolios.

Key Features and Services

- Advanced Sentiment Analysis: Utilizes sentiment analysis to predict stock trends, particularly effective during the 9:30 AM to 9:30 AM +1 time slot, as demonstrated in their 2023 research published in PeerJ Comput Sci.

- Integration of AI and NLP: Streamlines research processes by integrating AI with Natural Language Processing (NLP), reducing the time to insights and simplifying complex tasks.

- Comprehensive Financial Data Access: Offers deep insights and quality financial data, including company fundamentals, estimates, and advanced analytics, at competitive pricing.

Pricing and Subscription Options

- Basic Plan: Priced at $49.99/month, billed quarterly, includes access to the US market and a free 7-day trial.

- Enterprise Plan: Features custom pricing per seat with discounts for multiple seats, providing global market coverage and tailored services for large financial institutions.

Alpha Research AI has established itself as a crucial resource for asset managers and financial analysts across Europe, the Americas, and Asia. By detecting changes in market sentiment and providing timely, data-driven insights, Alpha Research AI empowers its clients with a competitive edge in the fast-paced world of stock trading.

StockGPT

StockGPT emerges as a revolutionary autoregressive AI model, meticulously engineered for stock prediction and trading. Developed by Dat Mai and detailed in the publication on arXiv.org in April 2024, StockGPT has been trained on a staggering dataset of 70 million daily U.S. stock returns spanning nearly a century up to the year 2000. Despite the historical nature of its training data, StockGPT continues to demonstrate formidable trading performance, even 23 years post the training data cut-off, showcasing its enduring relevance and accuracy in the volatile stock market landscape.

Key Performance Metrics

- Longevity and Accuracy: Trained on data only up to 2000, yet provides robust trading signals effective up to 2023.

- Impressive Returns: A daily rebalanced long-short portfolio based on StockGPT predictions reported an annual return of 119% with a Sharpe ratio of 6.5 on a held-out test sample from 2001 to 2023.

- Attention Mechanism: Utilizes an advanced attention mechanism to uncover hidden patterns in stock data that are predictive of future market movements.

The potential of StockGPT is not just limited to historical data analysis. The model offers flexibility for enhancement, such as retraining with new stock data as it becomes available, ensuring that it remains a cutting-edge tool for market analysts and traders. Furthermore, the integration of StockGPT with ChatGPT and OpenAI APIs by the Freedium Team illustrates its adaptability in leveraging current technologies to predict market trends based on news headlines and historical data.

Expanding Capabilities with AI

- Integration with ChatGPT: Utilizes AI to analyze sentiment and predict market movements from news headlines and historical data.

- Responsive to Market Sentiment: Studies, like those from the University of Florida, show that AI-driven sentiment analysis can significantly outperform traditional market strategies, turning $1 into over $5.50 based on news sentiment alone.

StockGPT not only stands as a testament to the power of AI in financial markets but also serves as a blueprint for future innovations where machine learning can intersect with real-time data analysis to offer unprecedented insights into stock market dynamics.

Trade Foresight

Trade Foresight, headquartered in Abu Dhabi, United Arab Emirates, with an additional office in Dover, Delaware, is a pioneering trade technology company. It offers a comprehensive suite of services including consultancy, digital marketing, and advanced trade technology solutions. The company's flagship product, Trade Advisor, is an AI-powered tool designed to provide personalized guidance on import and export regulations, trade policies, and global market trends. Available on Google Play and the web, with an upcoming release on the App Store, Trade Advisor supports over 85 languages and is accessible via WhatsApp, mobile applications, and a web portal.

Key Features of Trade Advisor

- Personalized Strategies: Tailors advice to individual business needs, enhancing the decision-making process.

- AI-powered Insights: Utilizes advanced algorithms to deliver real-time insights based on comprehensive trade datasets.

- User-Friendly Interface: Designed for ease of use, ensuring that users of all technical skill levels can navigate and utilize the platform effectively.

- Continuous Learning and Improvement: Adapts to new data and evolving global trade conditions to provide the most current advice.

Trade Foresight also offers the AI Forecasting Tool for Trading, which includes features like Global Trade Analytics and the Traders' Lounge. These tools allow users to analyze import and export potentials, market and industry potentials, and even create detailed trade reports. Additionally, the platform facilitates finding business partners through AI and promotes products and services effectively via its integrated marketing tools.

Comprehensive Trade Facilitation Services

- Trade Authorities and Associations: Provides connections with essential trade bodies and associations.

- Trade Agreements: Offers detailed insights into existing trade agreements and how they can benefit users.

- Trade Financing Institutions: Links businesses with financial institutions that offer trade financing solutions.

- Logistics Companies: Connects users with logistics providers to streamline the movement of goods.

The platform's mobile application ensures that users have on-the-go access to comprehensive trade data and analysis, making it a versatile tool for businesses looking to expand globally. With a flat-rate SaaS pricing model starting at $39 per month, Trade Foresight positions itself as a disruptive force in the traditional B2B platform and directory space, providing cutting-edge trade tools and solutions at an affordable cost.

Quadency

Quadency is a comprehensive crypto trading platform that integrates top-tier exchanges and offers advanced charting capabilities through TradingView. Trusted by over 100,000 users, the platform simplifies the trading experience with a variety of automated trading bots designed to perform across different market conditions. Key to its user-friendly approach is Cody, an AI trading assistant that enables users to engage with trading strategies without the complexities of traditional trading interfaces.

Key Features and Capabilities

- Diverse Trading Bots: Quadency includes a range of automated bots such as Accumulator, MACD, Mean Reversion, and Bollinger Bands, catering to various trading strategies.

- AI-Enhanced Trading: Cody, the AI strategy assistant, allows users to create and manage their own trading bots, making sophisticated trading accessible to all levels of traders.

- Smart Order Routing: Ensures instant and secure trades by integrating both centralized and decentralized exchange liquidity.

Quadency not only prioritizes ease of use and accessibility but also focuses on security and comprehensive market analysis tools. The platform’s security-first approach protects customer data and assets effectively. For those seeking enhanced functionality, Quadency offers premium features at a fair price, which includes advanced bot options and discounted fees through the QUAD token. Additionally, the platform provides an all-in-one solution for crypto investment tracking, which features real-time performance tracking and enhanced portfolio analytics, available on mobile devices for on-the-go asset management.

Kavout

Kavout, a global InvesTech company, has been at the forefront of integrating advanced technologies like machine learning, neural networks, and deep learning into the investment world since 2016. Originating from a French term meaning 'to find,' Kavout's mission is to democratize AI and machine learning, empowering institutions and investors with augmented intelligence to generate alpha, manage wealth, and do more with less. Their team comprises world-class experts from high-tech and finance sectors, including alumni from Google, Microsoft, and Wall Street firms, ensuring a blend of top-tier expertise in both technology and finance.

Key Features and Solutions

- K Score & Latest Factors: Kavout offers the 'K Score,' a predictive equity rating that aids investors in making confident buy or sell decisions. Coupled with 'Latest Factors,' which provides insights at a reduced cost, the platform offers broad coverage and a long history of automated data feeds.

- Portfolio Toolbox & Signal DB: Designed for both investors and advisors, the Portfolio Toolbox allows for the integration of ETFs with direct indexing to exert more control over investments. Meanwhile, Signal DB caters to quant and financial analysts, offering specialized data sets for deeper market analysis.

- Machine Learning Solutions: Soon to be released, these solutions are tailored for institutions, asset firms, and partnerships, showcasing Kavout's commitment to expanding its technological offerings.

Kavout's AI-powered investment analysis tool is an all-encompassing solution that aids users in discovering stock ideas across various parameters. Whether identifying trends in bearish or bullish stocks, sector-specific stocks like healthcare or energy, or even undervalued stocks, the tool leverages a multitude of technical and financial models for comprehensive analysis. It also features an AI-powered stock pick feature that processes natural language inputs to generate personalized stock recommendations, considering fundamental ratios like P/E, P/B, D/E, and ROE.

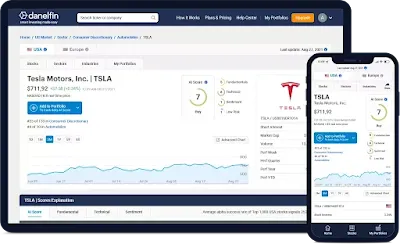

Danelfin

At the heart of Danelfin AI's financial advisory capabilities is its sophisticated use of the EODHD API, which extracts and analyzes news articles to gauge market sentiment. This analysis is pivotal in assessing whether the market tone is positive or negative, directly influencing investment decisions. Danelfin's seamless integration of this API demonstrates its commitment to providing data-driven insights that are critical for informed trading and investment strategies.

Danelfin AI distinguishes itself by offering a unique AI Score, which predicts the probability of outperforming the market over the next three months. This score is meticulously calculated using over 10,000 features per stock or ETF each day, drawn from an extensive range of indicators including 600 technical, 150 fundamental, and 150 sentiment indicators. The effectiveness of the AI Score is underscored by its historical performance; for instance, US stocks rated with the highest AI Score (10/10) have outperformed the S&P 500 by an average of 14.69% after three months over the last five years.

To further aid financial advisors and investors, Danelfin offers a 14-day free trial and various subscription plans, providing access to a list of top stock, ETF, and trade ideas for the upcoming quarter. The platform supports both US stocks and STOXX Europe 600 stocks, making it a versatile tool for a global audience. Additionally, Danelfin enriches its service with portfolio tools like the Average AI Score and Portfolio Diversity Score, and keeps users informed with daily alerts about significant AI Score changes, ensuring that subscribers can respond swiftly to market shifts.

Truewind

Truewind is revolutionizing the field of financial management for startups, SMBs, and accounting firms with its next-generation AI-powered platform. Designed to streamline and enhance the efficiency of financial operations, Truewind offers a suite of services that automate and optimize month-end close processes, bookkeeping, and comprehensive CFO services. The platform’s AI Assistant is particularly noteworthy, automating tasks such as data categorization, supporting documentation collection, and client follow-up, which significantly reduces administrative overhead and accelerates the closing process.

The security and reliability of Truewind are underscored by its SOC 2 certification and adherence to OpenAI's stringent data privacy policies, ensuring that all user data is handled with the utmost security. For businesses concerned with compliance and data integrity, Truewind provides a robust solution that integrates seamlessly with popular financial tools like QuickBooks Online, Plaid, Bill.com, and Sage Intacct. This integration not only simplifies the workflow but also enhances visibility and control over financial processes, making it easier for teams to collaborate and make informed decisions.

Truewind's unique AI-powered features extend beyond traditional financial management. The platform offers advanced capabilities such as contract summarization, transaction audit trails, and supports documentation automation. These features are designed to provide detailed insights and accurate information, which are crucial for effective financial planning and reporting. Additionally, Truewind assists in federal and state tax filings and R&D tax credits, offering dedicated tax preparer support to ensure compliance and maximize financial benefits. With its comprehensive and customizable solutions, Truewind is tailored to meet the diverse needs of its target markets, driving efficiency and strategic financial management across various business operations.

Conclusion

Navigating the complex terrain of the stock market demands not only keen intuition but also powerful analytical tools. This comprehensive guide has traversed from AI-driven platforms enhancing traditional trading strategies through sentiment analysis, to advanced AI models predicting market trends with unprecedented precision. Each tool and platform presented underscores the value of leveraging artificial intelligence in stock market analysis, illustrating the profound ways in which AI can enhance decision-making processes, manage risks effectively, and unlock potential growth opportunities for investors and traders alike.

As we conclude, it's evident that the fusion of technology and financial markets through AI is not merely a trend but a transformative force reshaping investment strategies. The significance of this evolution extends beyond immediate financial gains, heralding a new era where data-driven insights reign supreme in optimizing portfolio performance and navigating market dynamics. In embracing these innovations, investors are not only equipped to face the volatility of the stock market but are also positioned advantageously for the burgeoning opportunities that lie ahead in this digitally accelerated financial landscape.

FAQs

1. What is the most recommended AI tool for analyzing the stock market?

Out of various AI tools available, Koyfin stands out as the most recommended tool for stock market analysis.

2. Which AI model is best suited for predicting stock prices?

The AI-based high-frequency trading (HFT) model is highly effective for predicting stock prices. It utilizes algorithms that perform trades in milliseconds, enabling investors and financial institutions to take advantage of small price differences.

3. What are the top three AI stocks to consider investing in currently?

(Currently, there is no specific answer provided for this question.)

4. Is it possible to use AI for stock trading?

While there isn't an AI that completely automates stock trading for retail investors, tools like Magnifi, an AI chatbot, are available to assist in making better investment decisions.

.png)

.webp)